Table of Contents

- Executive Summary: 2025 Market Pulse and Growth Forecasts

- Technology Deep Dive: High-Fidelity Waveform Hydrography Explained

- Key Players and Innovators: Leading Companies and Partnerships

- Emerging Applications: From Coastal Mapping to Renewable Energy

- Market Drivers and Restraints: What’s Fueling Demand in 2025–2030?

- Case Studies: Real-World Deployments and Results

- Regulatory Landscape and Industry Standards (e.g., IHO.org, NOAA.gov)

- Competitive Analysis: Differentiators and Innovation Pipelines

- Investment, M&A, and Funding Spotlight in the Sector

- Future Outlook: Disruptive Trends, Forecasts, and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Pulse and Growth Forecasts

High-fidelity waveform hydrography is positioned for significant growth in 2025 and the following years, driven by advancements in acoustic and lidar-based sensor technologies, as well as expanding applications across marine, coastal, and inland water mapping. The sector is experiencing heightened demand due to global infrastructure projects, climate change monitoring initiatives, and the ongoing modernization of hydrographic fleets. In 2025, industry leaders are capitalizing on improvements in waveform digitization, real-time processing, and data fusion, enabling higher accuracy and greater detail in bathymetric and seabed characterization.

Key manufacturers such as Kongsberg Maritime and Teledyne Marine continue to innovate high-resolution multibeam echosounders and lidar systems, integrating sophisticated waveform processing algorithms. These advancements are addressing the growing requirement for precise hydrographic data in support of offshore wind farm development, dredging, port expansion, and environmental monitoring. Notably, the adoption of high-fidelity systems is facilitating compliance with international hydrographic standards set forth by the International Hydrographic Organization, further catalyzing market expansion.

- In early 2025, multiple national hydrographic offices, including those in Europe and Asia-Pacific, have announced procurement programs for next-generation waveform sensors to support updated nautical charting and coastal resilience projects. This trend is expected to accelerate, with fleet modernization initiatives extending into 2026 and beyond.

- Commercial sector engagement is intensifying, with energy, infrastructure, and environmental firms investing in survey-grade waveform hydrography solutions for both shallow and deepwater operations. As a result, suppliers such as Sea-Bird Scientific are expanding their product portfolios to include integrated platforms capable of both water column and seabed analysis.

- The integration of artificial intelligence for automated data processing is emerging as a transformative factor, reducing turnaround times and enhancing the quality of deliverables for marine surveyors and government agencies.

Looking ahead, the outlook for high-fidelity waveform hydrography remains robust. Market momentum is expected to be sustained by ongoing investments in digital infrastructure, growing regulatory requirements for hydrographic data, and the push toward autonomous survey platforms. As the technology matures, the sector is set to deliver increasingly comprehensive, high-resolution datasets, underpinning critical decisions in maritime safety, coastal management, and offshore development.

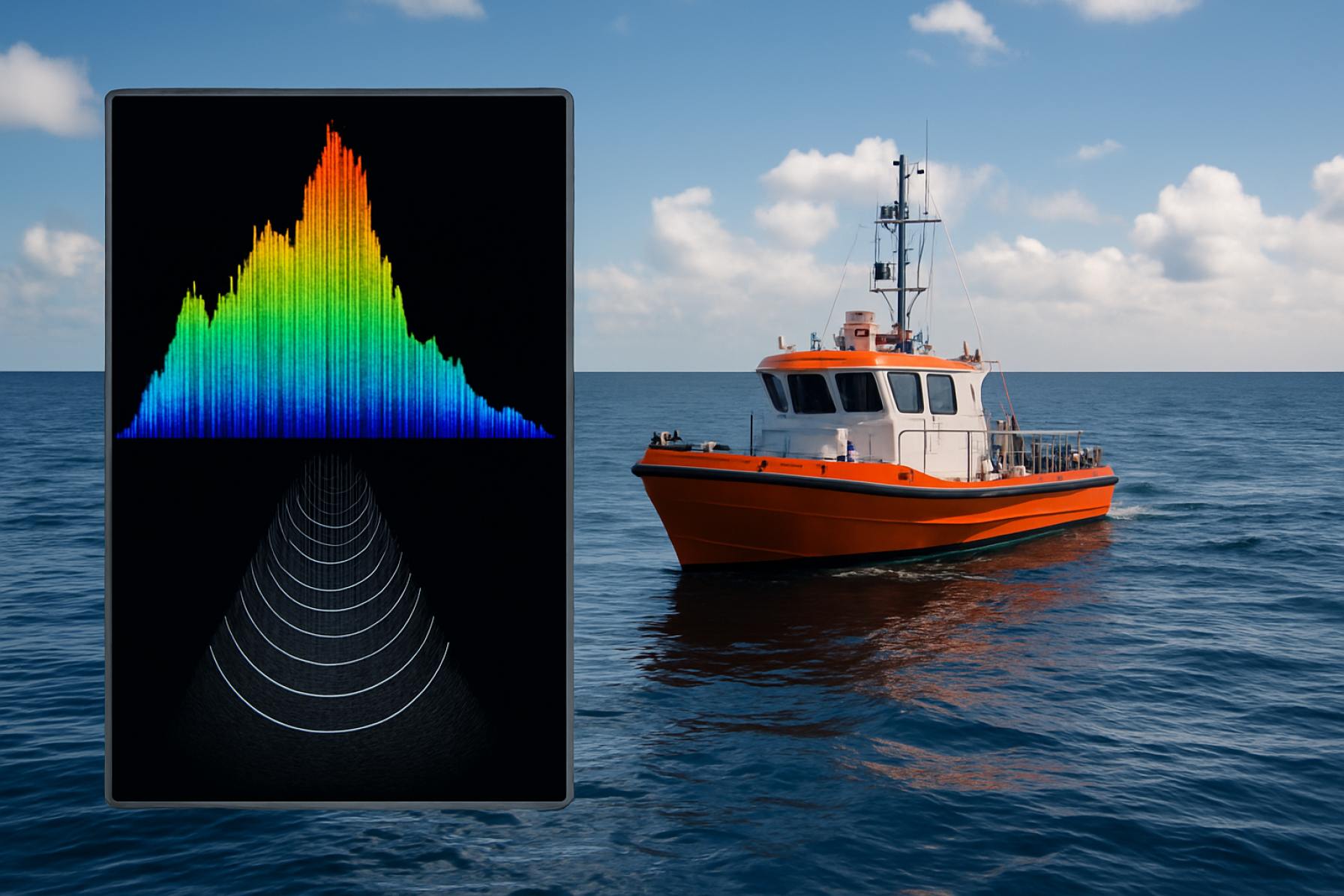

Technology Deep Dive: High-Fidelity Waveform Hydrography Explained

High-fidelity waveform hydrography represents a significant leap in underwater mapping and bathymetric accuracy, utilizing the full returned signal (the waveform) from sonar or lidar pulses to extract detailed environmental information. Unlike traditional hydrographic techniques that record only the time of arrival of a single echo, high-fidelity waveform systems capture the intensity and shape of the entire backscattered signal. This enables the discrimination of multiple targets within a single pulse footprint, finer vertical resolution, and improved characterization of seafloor and water column features.

In 2025, the maritime sector is experiencing rapid adoption of high-fidelity waveform hydrography across hydrographic survey, offshore energy, and marine research applications. Leading manufacturers have launched new generations of multibeam echosounders and airborne bathymetric lidars that deliver unprecedented data fidelity. For example, Kongsberg Maritime and Teledyne Marine have integrated advanced waveform processing into their latest multibeam sonar portfolios, enabling simultaneous detection of complex seabed structures, submerged vegetation, and even small objects on or just above the seafloor. These systems record the full echo for each beam, allowing for the extraction of additional information such as bottom hardness, sediment type, and improved detection in turbid or shallow waters.

On the airborne side, companies like RIEGL are pioneering high-fidelity bathymetric lidar sensors that leverage waveform digitization to map both topography and shallow waterbeds in a single flight. Such systems can resolve sub-decimeter features and improve mapping coverage even in optically challenging environments—capabilities critical for coastal resilience, habitat mapping, and disaster response.

Data volumes from waveform hydrography are substantial, but advances in onboard processing, AI-enabled feature extraction, and cloud-based analytics are making real-time or near-real-time data delivery increasingly practical. The International Hydrographic Organization (IHO) is updating standards to incorporate the richer datasets and metadata generated by waveform systems, supporting broader interoperability and data sharing.

Looking ahead to the next several years, the sector anticipates further miniaturization of high-fidelity sensors for integration into autonomous surface and underwater vehicles. The adoption of AI-driven processing pipelines is expected to automate much of the data interpretation, accelerating the delivery of actionable insights for subsea infrastructure, environmental monitoring, and national hydrographic charting. As these technologies mature, high-fidelity waveform hydrography is set to become the new benchmark for precision and efficiency in marine mapping.

Key Players and Innovators: Leading Companies and Partnerships

The high-fidelity waveform hydrography sector is witnessing robust activity in 2025, driven by a combination of established defense contractors, specialized sensor manufacturers, and innovative technology firms. These key players are advancing hydrographic survey capabilities, leveraging the latest developments in full-waveform LiDAR, multi-beam sonar, and integrated data analytics. Collaboration between industry leaders and research institutions is fostering breakthroughs in data resolution, coverage, and real-time processing—transforming both marine mapping and inland waterway management.

Among the notable companies, Teledyne Technologies continues to play a pivotal role. Its subsidiary, Teledyne Marine, is recognized globally for advanced bathymetric and topographic LiDAR systems and high-resolution multibeam echosounder solutions. In 2025, Teledyne’s focus is on enhancing waveform digitization and real-time data analytics, supporting initiatives for coastal resilience and infrastructure monitoring in collaboration with governmental hydrographic offices.

Another significant innovator is Kongsberg Gruppen, whose Kongsberg Maritime division supplies multi-beam echosounder and acoustic data acquisition systems widely used in high-fidelity hydrography. Kongsberg’s 2025 roadmap emphasizes cloud-based data sharing and near-instantaneous seabed modeling, building on partnerships with global survey companies and naval authorities for applications ranging from offshore energy site characterization to safe navigation.

Emerging companies are also influencing the sector. RIEGL is at the forefront of waveform LiDAR technology, producing airborne and UAV-mounted solutions that offer high-density point clouds for shallow water and near-shore mapping. Their 2025 product releases focus on longer-range capabilities and seamless integration with real-time kinematic GNSS systems, addressing the growing demand for rapid, large-area hydrographic surveys.

Additionally, Leica Geosystems, part of Hexagon, is expanding its offerings in marine and coastal hydrography, integrating full-waveform laser scanners with advanced positioning solutions. The company’s collaborations with port authorities and environmental monitoring agencies in 2025 illustrate the growing importance of precise waterbody mapping for infrastructure development and climate adaptation.

Strategic partnerships continue to shape the industry outlook. For instance, alliances between hardware developers and cloud analytics providers are enabling on-demand, high-resolution mapping services. Furthermore, cooperation between sensor manufacturers and research organizations is accelerating the standardization of waveform data formats and the adoption of AI-enhanced interpretation pipelines.

Looking ahead, the interplay between established leaders like Teledyne and Kongsberg and agile innovators like RIEGL and Leica Geosystems is expected to sustain rapid technological progress, with further convergence of hydrographic, geospatial, and AI-driven analytics anticipated through 2026 and beyond.

Emerging Applications: From Coastal Mapping to Renewable Energy

High-fidelity waveform hydrography is rapidly advancing as a transformative tool for diverse marine and freshwater applications, particularly between 2025 and the coming years. This technology leverages full-waveform LiDAR and multi-spectral bathymetric systems to capture highly detailed three-dimensional representations of underwater environments, surpassing the limitations of traditional single pulse or discrete return sensors. The resulting datasets enable unprecedented resolution and accuracy in submerged terrain mapping, water column analysis, and object detection, making them invaluable for emerging sectors such as coastal zone management, renewable energy siting, and habitat conservation.

In 2025, a surge in coastal mapping initiatives is underway, driven by the need for resilience against climate change and improved disaster risk assessment. High-fidelity waveform hydrography allows for precise delineation of shoreline changes, sediment transport, and habitat boundaries, supporting regulatory compliance and sustainable development. Key industry players such as Teledyne Technologies Incorporated and Leica Geosystems are actively deploying waveform LiDAR systems capable of capturing both shallow and deeper coastal waters, enabling seamless integration with terrestrial topographic data for holistic coastal zone models.

The renewable energy sector increasingly depends on accurate hydrographic data to identify optimal locations for offshore wind, tidal, and wave energy installations. In 2025, countries with ambitious net-zero targets are commissioning high-fidelity surveys to map seafloor morphology, substrate types, and benthic habitats, minimizing ecological impact and optimizing engineering design. Companies like Kongsberg Maritime and Sonardyne International Ltd. provide advanced multibeam and LiDAR solutions that deliver dense, high-precision point clouds for both environmental baseline studies and real-time monitoring during construction and operation.

Beyond commercial applications, national hydrographic offices and environmental agencies are integrating waveform hydrography into monitoring programs for water quality, flood prediction, and ecosystem health. The ability to extract water column properties and bottom reflectivity supports the detection of algal blooms, submerged vegetation, and other biologically significant features. In the next few years, as computational capacity and data fusion techniques mature, the outlook for high-fidelity waveform hydrography includes greater automation in feature extraction, improved interoperability with satellite data, and democratization of access via cloud-based processing platforms. These developments are expected to accelerate the adoption of high-resolution hydrographic data in policy, planning, and operational decision-making worldwide.

Market Drivers and Restraints: What’s Fueling Demand in 2025–2030?

High-fidelity waveform hydrography is experiencing notable momentum as a result of several converging market drivers and emerging restraints that will shape its trajectory from 2025 through 2030. This technology, which leverages advanced LiDAR, multibeam sonar, and other acoustic or laser-based methods to capture highly detailed underwater topography, is increasingly vital for sectors such as offshore wind, coastal infrastructure, defense, and environmental monitoring.

Market Drivers (2025–2030):

- Offshore Renewable Energy Expansion: The global surge in offshore wind and marine energy projects is a primary catalyst. Developers require precise seafloor mapping for site selection, installation, and ongoing asset monitoring. High-fidelity waveform hydrography delivers the accuracy and resolution needed to minimize risk and reduce project costs. Major players like Kongsberg Gruppen and Teledyne Marine continue to innovate in multibeam and bathymetric LiDAR, supporting this sector’s robust growth.

- Coastal Vulnerability and Climate Adaptation: Rising sea levels and intensifying storm events are driving government agencies and civil engineers to invest in detailed hydrographic data for flood risk mapping, shoreline change detection, and habitat conservation. Organizations such as US Geological Survey (USGS) and NOAA are expanding their acquisition of high-resolution bathymetric data, often through public-private partnerships.

- Automation and AI Integration: The integration of AI-driven processing and autonomous survey platforms is rapidly improving data acquisition efficiency. Companies like Fugro are deploying uncrewed surface vessels (USVs) equipped with cutting-edge waveform sensors, further reducing operational costs and enabling persistent monitoring.

Market Restraints (2025–2030):

- Capital and Operational Costs: Despite technological advances, high-fidelity systems remain expensive to acquire, operate, and maintain. Smaller hydrographic surveyors and developing countries may struggle to justify investment without strong demand or government support.

- Data Processing and Storage Burdens: The sheer volume and complexity of waveform hydrography data require robust IT infrastructure and skilled analysts, presenting a bottleneck for widespread adoption, particularly for organizations with limited resources.

- Regulatory and Environmental Constraints: Increasing scrutiny around subsea survey operations, especially concerning marine mammal disturbance and data privacy, can delay or restrict deployments in sensitive regions.

Looking ahead to 2030, these drivers and restraints will continue to shape the adoption curve of high-fidelity waveform hydrography. However, as technology matures and costs gradually decline, broader uptake across sectors is anticipated, especially as policy mandates for environmental monitoring and sustainable coastal management intensify.

Case Studies: Real-World Deployments and Results

High-fidelity waveform hydrography has gained significant momentum in recent years, with real-world deployments demonstrating its advantages for aquatic mapping, coastal monitoring, and infrastructure inspection. As of 2025, several noteworthy case studies highlight both the technological maturity and the operational benefits of this approach across diverse environments.

One prominent example is the integration of high-fidelity waveform LiDAR systems in national hydrographic surveys. Agencies such as the United States National Oceanic and Atmospheric Administration (NOAA) have showcased how advanced waveform digitization, coupled with full-waveform bathymetric LiDAR, enables precise mapping of shallow coastal zones, estuaries, and riverbeds. Their deployments along the US Atlantic and Gulf coasts in 2023–2024 demonstrated that waveform hydrography could resolve features as small as submerged debris and small-scale topographic changes, supporting both navigation safety and habitat assessment.

Another case study involves the use of high-fidelity waveform technologies by marine engineering firms to inspect underwater infrastructure. Teledyne Technologies has partnered with port authorities in Europe to deploy their next-generation bathymetric LiDAR systems for rapid assessment of quay walls and submerged assets. Early 2024 deployments in the Port of Rotterdam revealed that waveform analysis allowed for detailed characterization of sediment build-up and structural anomalies, reducing the need for diver-based inspections and enhancing maintenance planning.

In Asia-Pacific, environmental monitoring agencies have turned to waveform hydrography for large-scale riverine and reservoir studies. For instance, RIEGL Laser Measurement Systems collaborated with regional governments in Southeast Asia to deploy their VQ-880-GII waveform LiDAR on airborne platforms. Case studies from 2023–2025 have shown the system’s ability to penetrate turbid waters and generate high-resolution bathymetric models, supporting flood management and water resource planning.

Looking ahead, ongoing pilots in Scandinavia are leveraging waveform hydrography for winter navigation and ice mapping, where traditional sonar systems face limitations. Initial results suggest that high-fidelity waveform data can distinguish between ice, slush, and open water, which is critical for Arctic shipping lanes.

These case studies underscore a broader industry trend: high-fidelity waveform hydrography is transitioning from niche to mainstream, with tangible results in accuracy, operational efficiency, and environmental understanding. As sensor technologies continue to evolve and more agencies adopt waveform-based solutions, we can expect a surge in deployments and an expanding portfolio of successful applications by 2026 and beyond.

Regulatory Landscape and Industry Standards (e.g., IHO.org, NOAA.gov)

High-fidelity waveform hydrography is positioned at the forefront of marine mapping and bathymetric data collection, offering substantial improvements in depth resolution, target discrimination, and water column characterization. As the adoption of these advanced technologies accelerates into 2025, regulatory frameworks and industry standards are evolving to ensure data quality, interoperability, and safety across diverse applications, including navigation, coastal management, and offshore development.

Central to the regulatory landscape is the ongoing work of the International Hydrographic Organization (IHO), which is responsible for setting global standards for hydrographic data acquisition and charting. The IHO’s S-44 standards—currently under active review and anticipated to be updated in the near future—specifically address the minimum requirements for hydrographic surveys, including those conducted using high-fidelity, full waveform systems. The forthcoming revisions are expected to incorporate more explicit guidance on waveform processing and associated data formats, responding to the proliferation of multibeam echosounder systems and the increased adoption of raw waveform data capture for post-processing.

In the United States, the National Oceanic and Atmospheric Administration (NOAA) continues to play a pivotal role. NOAA’s Office of Coast Survey and the National Centers for Environmental Information have issued specifications for hydrographic survey data, aligning closely with IHO recommendations while also establishing national protocols for data accuracy, metadata, and archiving. In 2025, NOAA is expected to further refine its acceptance criteria and data submission requirements for projects utilizing high-fidelity waveform technology, particularly as more commercial and government vessels are equipped with new generation systems.

Additionally, the IHO has accelerated the development and adoption of the S-100 Universal Hydrographic Data Model, which underpins next-generation digital hydrographic products. S-100 is designed to accommodate the complex, information-rich datasets produced by waveform-resolving sonars and to facilitate interoperability between national hydrographic offices, industry stakeholders, and end-users. As part of this initiative, specialized working groups are collaborating with manufacturers and data processors to standardize the encoding, exchange, and visualization of full waveform data.

Looking ahead, regulatory authorities and industry bodies are expected to introduce further updates to survey standards, data formats, and certification protocols as high-fidelity waveform hydrography becomes more ubiquitous. Stakeholders are actively engaged in international forums and technical committees to ensure that emerging standards reflect advances in sensor technology and data analytics, supporting the safe and efficient mapping of increasingly complex aquatic environments.

Competitive Analysis: Differentiators and Innovation Pipelines

The landscape of high-fidelity waveform hydrography is rapidly evolving, characterized by a concentrated focus on differentiation through advanced acoustic technologies, real-time data processing, and integration with autonomous platforms. Heading into 2025, the sector’s leading players are leveraging innovation pipelines to deliver greater resolution, efficiency, and adaptability to varied marine environments.

A core competitive differentiator remains the adoption of true waveform digitization in multibeam echo sounders and bathymetric lidar systems. Companies such as Kongsberg Maritime and Teledyne Marine are at the forefront, offering systems that capture the full acoustic or optical return, allowing for more accurate seafloor mapping—especially in challenging shallow or complex terrains. For example, the latest multibeam systems employ multi-ping, wide-swath, and dual-head configurations, markedly increasing coverage and data density. These advances are married with onboard machine learning algorithms for noise discrimination and feature extraction, reducing post-processing time and operator workload.

Another key innovation pipeline is the move toward seamless integration with autonomous and remotely operated vehicles (AUVs and ROVs). Hydro Survey Systems and Sonardyne International are actively developing lighter, more power-efficient high-resolution sensors tailored for long-duration deployments on unmanned platforms. The convergence of high-fidelity waveform hydrography with AI-driven navigation and adaptive mission planning is anticipated to unlock new applications in deep-sea exploration, offshore energy, and environmental monitoring from 2025 onwards.

Cloud-based data management and real-time processing are further shaping competitive advantages. Providers like Fugro are pioneering cloud-enabled workflows, where raw waveform data is streamed, processed, and visualized remotely—enabling near-instant decision-making and collaborative analysis across global teams. This shift also underpins emerging service models, such as data-as-a-service (DaaS), which lower entry barriers for clients needing high-precision hydrographic data without capital investments in hardware.

Looking ahead, innovation pipelines are increasingly oriented toward miniaturization, interoperability, and sensor fusion—combining acoustic, optical, and inertial measurements for richer environmental context. The competitive race in 2025 and beyond will favor those able to deliver scalable, ultra-high-resolution solutions adaptable to both coastal and deep-ocean regimes, while addressing mounting demands for sustainability, cost efficiency, and unmanned autonomy in marine operations.

Investment, M&A, and Funding Spotlight in the Sector

High-fidelity waveform hydrography is witnessing significant investment and consolidation activity as the sector rapidly advances in sophistication and commercial relevance. Recent years have seen major players in hydrography, marine technology, and geospatial intelligence intensify their focus on waveform-resolving sonar systems, motivated by demand for greater accuracy in seabed mapping for offshore energy, environmental monitoring, and national security.

In 2025, the momentum continues from notable mergers and acquisitions that occurred in the early 2020s. Leading the charge, Kongsberg Gruppen has sustained a pattern of strategic investments, expanding its high-resolution multibeam and synthetic aperture sonar portfolio. Their acquisition spree, bolstered by continued R&D funding, has solidified Kongsberg’s position as a global leader. Similarly, Teledyne Technologies has expanded its capabilities through the integration of advanced waveform processing platforms, following its earlier absorption of key hydrographic instrumentation manufacturers. These moves are aimed at providing comprehensive, end-to-end hydrographic solutions, with a particular emphasis on waveform digitization and analysis.

Venture capital and private equity have also entered the fray, targeting start-ups and scale-ups specializing in artificial intelligence (AI)-driven interpretation of full-waveform bathymetric data. Several technology incubators in Europe and North America are nurturing early-stage companies developing compact, high-fidelity sonar systems and cloud-native data analytics pipelines. Although deal sizes remain modest compared to mature sectors, the increased frequency of seed and Series A rounds signals the growing recognition of waveform hydrography’s potential for autonomous vessel navigation and rapid response mapping.

On the collaborative front, joint ventures and public-private partnerships are reshaping the competitive landscape. The Nippon Foundation-GEBCO Seabed 2030 Project continues to drive global data collection initiatives, fostering alliances between sensor manufacturers, survey operators, and national hydrographic offices. Leading industrial actors—including Fugro and Equinor—are also pursuing direct investment in custom waveform hydrography platforms, reflecting their reliance on precise seafloor characterization for offshore operations.

Looking ahead, the sector is anticipated to see further consolidation as established defense and marine technology firms seek to secure access to next-generation waveform processing IP and data management expertise. The outlook for 2025-2027 includes increased cross-border acquisitions, the emergence of regional champions, and heightened collaboration between hardware manufacturers and geospatial analytics providers. As governments and the private sector demand higher-resolution, real-time ocean mapping, investment flows are likely to accelerate, reshaping the competitive dynamics and spurring innovation in high-fidelity waveform hydrography.

Future Outlook: Disruptive Trends, Forecasts, and Strategic Recommendations

High-fidelity waveform hydrography is poised for significant evolution through 2025 and the subsequent few years, driven by advances in sensor technology, data processing algorithms, and integrated platform development. The transition from traditional single- and multi-beam echo sounders to full-waveform LiDAR and advanced sonar is enabling unprecedented accuracy in bathymetric surveys, shallow water mapping, and coastal change detection.

A key disruptive trend is the widespread adoption of full-waveform bathymetric LiDAR systems that capture the entire return signal, allowing for superior penetration in turbid or complex water conditions and delivering richer datasets. Companies like RIEGL and Teledyne Technologies are investing in next-generation airborne and marine LiDAR sensors that offer higher pulse rates, multi-channel acquisition, and improved signal processing, enabling denser point clouds and more accurate water surface and bottom detection. Similarly, Kongsberg Maritime is advancing high-fidelity multibeam sonar systems with enhanced waveform digitization, supporting applications ranging from port infrastructure surveys to habitat mapping.

Emerging hydrography software platforms are leveraging artificial intelligence and machine learning to automate and refine waveform data analysis, addressing challenges like noise discrimination, object classification, and sediment characterization. Companies such as Teledyne CARIS are integrating AI-driven workflows into their solutions to accelerate processing and improve deliverable accuracy. This technology convergence is anticipated to reduce survey turnaround times and operational costs, while enhancing the value of hydrographic data for environmental monitoring and coastal resilience planning.

Looking ahead, the integration of high-fidelity waveform hydrography with autonomous surface and underwater vehicles is set to redefine survey efficiency and accessibility. Manufacturers like Hydroid (a Kongsberg company) and Sea Technology are developing autonomous platforms equipped with advanced waveform sensors, enabling persistent, high-resolution mapping in previously inaccessible or hazardous areas. The interoperability of these platforms with real-time cloud-based data services will facilitate near-instantaneous data sharing and collaborative analysis, supporting critical infrastructure monitoring and disaster response.

Strategically, stakeholders should prioritize investment in modular, upgradable sensor suites and open-architecture data ecosystems to ensure future compatibility and scalability. Partnerships between sensor manufacturers, platform providers, and end-users will be crucial for driving standardization and unlocking the full potential of high-fidelity waveform hydrography. As regulatory frameworks evolve to accommodate new technologies, industry bodies such as the International Hydrographic Organization are expected to play a pivotal role in setting global standards and promoting best practices for data quality and interoperability.

Sources & References

- Kongsberg Maritime

- Teledyne Marine

- International Hydrographic Organization

- Sea-Bird Scientific

- IHO

- Teledyne Technologies

- Fugro

- Teledyne Technologies

- The Nippon Foundation-GEBCO Seabed 2030 Project

- Equinor

- Kongsberg Maritime

- Sea Technology